Microsoft Dynamics AX 2012 Intercompany – Principal Company Model

Purpose: The purpose of this document is to illustrate how to implement Principal Company Model in Microsoft Dynamics AX 2012.

Challenge: According to KPMG Global Manufacturing Outlook 2013 ("A taxing environment for manufacturers") the topic of tax planning becomes increasingly important for manufacturers in order to optimize costs and stay profitable.

… It may be time for manufacturers to put their tax department on speed-dial. Indeed, as I look across the findings in this report, one thing becomes clear: the issue of tax is even more important for manufacturers than even before. And rightfully so. These organizations that are able to enhance their competitive position and reduce their risk using smart and transparent tax planning will almost certainly gain an advantage over their peers …

I'll also refer to KPMG Global Manufacturing Outlook 2012 ("Near-shoring financial benefits – think tax early") to highlight the fact that ERP implementations nowadays often have requirements to implement complex intercompany scenarios driven by number of factors, for example, tax

… One of the critical components to this reassessment - which is often overshadowed by other operational agility elements - should be the financial considerations, e.g. the contractual, currency, and tax advantages that moving to a regional sourcing model may offer … If they are located in low-tax countries, such as Switzerland or Luxembourg, both preferred sourcing locations within Europe, or Singapore and Hong Kong in Eastern Asia, or Costa Rica or Panama in the Americas, they may see additional benefit to their strategies via those jurisdictions' competitive tax policies …

These complex intercompany scenarios include Holding company, Mixed company, Principal company, etc. This poses a challenge for ERP packages from the perspective of Supply Chain automation and transparency.

Solution: Intercompany feature allows for the exchange of documents between internal trade partners. Sales and purchase order documents are transferred automatically between the intercompany trade partners using the document transfer methods from the Microsoft Dynamics AX Integration Framework feature

When you create an intercompany sales order, Microsoft Dynamics AX creates a corresponding purchase order automatically. Similarly, creating an intercompany purchase order prompts the automatic creation of a corresponding intercompany sales order

This is true for two-legged orders (transactions between two related companies) and for most three-legged companies when an intercompany transaction originates with a sales order for an external customer.

The main idea behind Principal Company Model is to provide a "tax shelter" in one of the low-tax countries so the most part of the revenue will land there. This will be implemented using Intercompany feature in Microsoft Dynamics AX 2012 with creation of 5 Intercompany orders: SO (Sales company) -> PO (Sales company) -> SO (Principal company) -> PO (Principal company) -> SO (Manufacturing company)

Scenario

In this walkthrough I'll implement Principal Company Model in Microsoft Dynamics AX 2012 using Intercompany feature primarily focusing on Supply Chain automation and transparency. Please note that other critical considerations may include tax, proper costing (transfer of cost), drop ship, security and more. I'll also highlight how abovementioned requirements can be implemented in Microsoft Dynamics AX 2012 as a part of Principal Company Model implementation using a standard functionality.

Schematically Principal Company Model can be represented as shown below

We have 3 companies involved and the goal is to automate Supply Chain operations and provide required level of operational transparency. That's why we expect that when we create the original Sales order in Sales company the system will help us to automatically generate all necessary documents in Intercompany chain. Also we expect that once we post Sales order in Manufacturing company physically (Packing slip) or financially (Invoice) upon completion of Production process the system will post all documents in Intercompany chain automatically for us.

Please note that in order to cover Sales order demand in Manufacturing company we have to execute MRP for Production order generation. We have number of options to do so, for example, you may choose to do local MRP in Manufacturing company if all materials are being procured into Manufacturing company or do Intercompany MRP across all companies involved which is in particular useful if some of materials are procured in different companies (other than Manufacturing company)

From costing perspective we want to make sure that we book the most of the revenue in Principal company to take advantage of low tax rates. In this example I assume that Sales company and Manufacturing company are located in the United States, and Principal company is located in Panama or Costa Rica. Please see the simplified diagram below which show how we transfer the price between companies in the Intercompany chain to ensure that the biggest margin is in Principal company and in other companies we just have a nominal margin of 1$

We will also implement drop ship requirement using standard Microsoft Dynamics AX 2012 direct delivery functionality. Finally security considerations will be taken into account and will be implemented using Microsoft Dynamics AX 2012 Security model. Thus, for example, the user in Manufacturing company should logically not have access to confidential info about margins in Principal company or Sales company.

Setup

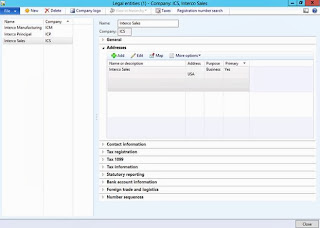

Companies

Here's the list of companies we'll need to implement Principal Company Model in Microsoft Dynamics AX 2012

Users

I'll also create 3 users, one for each company and assign appropriate security permissions for them using Access by organization capability

Manufacturing user

Access by organization (Manufacturing company)

Please note that Manufacturing user will only have access to the data in Manufacturing company

Principal user

Access by organization (Principal company)

Please note that Principal user will have access to the data in all companies and will be able to navigate through the entire Intercompany chain

Sales user

Access by organization (Sales company)

Please note that Sales user will only have access to the data in Sales company

I'm going to use the same Mode of delivery, Delivery terms in all companies and assume that we have them set up this way

Sales company

In Sales company we will first set up an external customer who will be placing original Sales order

External Customer

External customer – Invoice and delivery

Please note that in order to automate Intercompany chain of documents creation we have to mark "Create intercompany orders" [V] checkmark. We also want to implement drop ship scenario and ultimately deliver goods to the customer directly from Manufacturing company, that's why I also mark "Direct delivery" [V] checkmark

Address

Please note that the address I provide for the customer in Sales company will be transferred all the way through the Intercompany chain to Manufacturing company for direct delivery

The next step is to define Intercompany Vendor in Sales company referencing Principal Company

IC Vendor (Principal Company)

Please review detailed Intercompany setup for Intercompany Vendor below

Intercompany setup – Trading relationship

Intercompany setup – Purchase order policies

Intercompany setup – Purchase value mapping

Intercompany setup – Purchase agreement policies

Intercompany setup – Sales order policies

Intercompany setup – Sales value mapping

Intercompany setup – Sales agreement policies

Now it's time to define a product we sell in Sales company

IC Product

Purchase – Default Vendor

Please note that in order to automatically generate Intercompany orders we have to define default vendor for the product who has Intercompany relationship set up

Trade agreements

Now we'll use trade agreements to make sure that we properly transfer price throughout Intercompany chain (based on costing diagram presented earlier)

Principal Company

In Principal company we start with creation of Intercompany Customer who will have Intercompany relationship with Intercompany Vendor in Sales company

IC Customer (Sales Company)

IC Customer - Invoice and delivery

Please note that it's important to mark "Create intercompany orders" [V] checkmark to let the system create all legs in Intercompany chain automatically

Please review detailed Intercompany setup for Intercompany Customer below

Intercompany setup – Trading relationship

Intercompany setup – Purchase order policies

Intercompany setup – Purchase value mapping

Intercompany setup – Purchase agreement policies

Intercompany setup – Sales order policies

Intercompany setup – Sales value mapping

Intercompany setup – Sales agreement policies

Next step is to create Intercompany Vendor linked to Intercompany Customer in Manufacturing company in order to continue Intercompany chain

IC Vendor (Manufacturing Company)

Please review detailed Intercompany setup for Intercompany Vendor below

Intercompany setup – Trading relationship

Intercompany setup – Purchase order policies

Intercompany setup – Purchase value mapping

Intercompany setup – Purchase agreement policies

Intercompany setup – Sales order policies

Intercompany setup – Sales value mapping

Intercompany setup – Sales agreement policies

Now it's time to define a product in Principal company. Please note that you can define the product once using Centralized Product information management approach and then release the product to all 3 companies at once

IC Product

IC Product - Purchase

Similarly we'll specify default Vendor who is Intercompany Vendor for the product to keep the ball rolling and let the system create all necessary legs of Intercompany chain

Trade agreements

We intend to book the most of the revenue in Principal company, that's why the sales price we specify here is significantly higher (50$ versus 15$) than the sales price we specified in Manufacturing company, and it's almost the same comparing to Sales company (the difference will be 1$ for nominal margin)

Manufacturing Company

Now in Manufacturing company we'll create Intercompany Customer linked to Intercompany Vendor in Principal company to complete the exercise

IC Customer (Principal Company)

Please review detailed Intercompany setup for Intercompany Customer below

Intercompany setup – Trading relationship

Intercompany setup – Purchase order policies

Intercompany setup – Purchase value mapping

Intercompany setup – Purchase agreement policies

Intercompany setup – Sales order policies

Intercompany setup – Sales value mapping

Intercompany setup – Sales agreement policies

Finally we'll create Vendor in Manufacturing company to supply the materials for Production process

IC Vendor (External Vendor)

In Manufacturing company we'll create 2 products, one will be the product we produce and another one will be material used in production process

Released products

IC Product

Trade agreements

Please note that we want to minimize margin in Manufacturing company, that's why the sales price for the product to Principal company will be 15$ and the cost of production will be 14$ (which will include the cost of material 10$ and the cost of labor 4$)

Now we'll create material product as well

Material

Trade agreements

For material product we'll define purchase price as 10$

For the sake of time I'll omit the definition of Product Bill of materials, Route, Resource and Operation

But the interesting thing about the Route is that we will set up Operation Cost Category with Hour price of 4$ (and we will consume 1 hour when producing the product) which will allow us to get the Cost of production as 14$ (10$+4$). This in its turn allows us to get a nominal margin of 1$ in Manufacturing company (15$ - 14$)

Please find the continuation of the scenario by going with links below

Part2 - Creation and Execution: http://ax2012manufacturing.blogspot.com/2013/09/microsoft-dynamics-ax-2012-intercompany_2087.html

Part3 - Security and Development: http://ax2012manufacturing.blogspot.com/2013/09/microsoft-dynamics-ax-2012-intercompany_12.html

Please find the continuation of the scenario by going with links below

Part2 - Creation and Execution: http://ax2012manufacturing.blogspot.com/2013/09/microsoft-dynamics-ax-2012-intercompany_2087.html

Part3 - Security and Development: http://ax2012manufacturing.blogspot.com/2013/09/microsoft-dynamics-ax-2012-intercompany_12.html

Cordial saludo:

ReplyDeleteMi nombre es Bernardo Escobar, trabajo con Calitech Services (www.calitech.net), un proveedor experimentado de hospedaje en la nube y servicios administrados para Microsoft Dynamics y Azure.

Desde el 2004 desarrollamos servicios e infraestructura 24x7x365 en nuestros data centers en California y Sudamérica.

Nos asociamos con empresas de consultoría y generamos ingresos adicionales para ellas ayudando a sus clientes.

Hoy en día se oye hablar mucho de la computación en la nube, y de la necesidad de tener una nube privada. Las organizaciones que se mudan a Calitech y utilizan nuestros servicios de hospedaje pueden enfocarse en su negocio principal y dejar que nosotros nos encarguemos de manejar y actualizar la tecnología, los centros de datos, el hardware y la red.

Las empresas de consultoría ganan ingresos adicionales al asociarse con Calitech, y sus clientes disfrutan de una infraestructura confiable y segura, y de un excelente servicio, de modo que pueden reducir tanto sus costos de TI como su riesgo.

Le escribo con el propósito de buscar alternativas conjunta de negocios y solicitarle una tele-conferencia con nuestro personal donde le queremos presentar la empresa y proponer que podemos darle una cotización formal personalizada para sus requerimientos, o configurar un servicio gratuito de prueba durante 2 meses para que usted mida el desempeño de nuestras soluciones.

Gracias por la atención prestada a la presente,

Best Regards,

--

Bernardo Escobar

Central America Director

Calitech Services LLC

Concepción Tres Ríos, Montserrat #52

Costa Rica

Direct: (506) 2273-8919

Mobile: (506) 8398-5032

-

Main Office:

2050 Martin Ave. Suite 8

Santa Clara, CA 95050

Office: (800) 325-9974

Nice. Very useful information for readers that you have shared. Keep posting like this.Microsoft Dynamics AX implementation partners

ReplyDeleteThe information which you have provided in this blog is really useful to everyone. Thanks for sharing.

ReplyDeleteMS Dynamics Trade and Logistics Online Training

ReplyDeleteIt is amazing to visit your site. Thanks for sharing this information, this is useful to me...

MS Dynamics Trade and Logistics Online Training

Microsoft Dynamics Operations Trade and logistics Training

Microsoft Dynamics operations Trade and Logistics

MS Dynamics Trade and Logistics Training

MS Dynamics Operation Trade and Logistics Training

I would highly recommend Mr, Benjamin services to any person in need financial help and they will keep you on top of high directories for any further needs. Once again I commend yourself and your staff for extraordinary service and customer service, as this is a great asset to your company and a pleasant experience to customers such as myself. Wishing you all the best for the future.Mr, Benjamin is best way to get an easy loan,here is there email.. 247officedept@gmail.com Or talk to Mr Benjamin On WhatsApp Via_+1-989-394-3740 Thank You for helping me with loan once again in my sincerely heart I'm forever grateful.

ReplyDeleteThanks for posting. Its an Important topic to be read.

ReplyDeleteMS Dynamics Technical Online Training

MS Dynamics AX Technical Training in Hyderabad

MS Dynamics AX Online Training

D365 AX Online Training

d365 ax technical online training

d365 ax technical training

Hi

ReplyDeleteHow does this direct delivery/non direct delivery in 3Legged scenario works for a service item?

when i try completing the sales order from the service provider

the system throws errors related to quantity update qunatity must be nonzero or Financial updating quantity must have same sign in the posting unit and the inventory unit.

Hi

ReplyDeleteHow does this direct delivery/non direct delivery in 3Legged scenario works for a service item?

If you look at the current scenario with regards to the grants for small business expansion, the federal government actually offers no direct grants. There are however, some programs by the government, through which grants for research and development activities that a small business might carry out are provided by the SBA. Then there are indirect grants in the form of small business loan guarantees as well as subsidized loans, wherein you get loans at reduced rate of interest from the bank as the government pays some part of your loan. Or if you default on your loan payment, the government pays the bank on your behalf. As you can see, there are opportunities galore for small business funding and grants through Mr Pedro and his funding company. They offer a loan at 2% rate which is very affordable. As a start-up business owner you just have to make an effort to find the one that is most suitable for your business goals.

ReplyDeleteContact Mr Pedro on pedroloanss@gmail.com for loans.

All the best!

Microsoft Dynamics Partnerwe are passionate about using technology to solve complex business problems.

ReplyDeleteWe created AlphaBOLD because we felt that with technology, we can help businesses be better.

Great article! It's fantastic to see the presence of Microsoft Partners in UAE. As a leading technology hub, UAE offers a vibrant business landscape and immense potential for growth. Microsoft Partners play a crucial role in delivering cutting-edge solutions and services to businesses across various industries.

ReplyDelete